On Freelance Switch, Thursday Bram posts about an issue freelancers commonly face: how do you prove your income?

This is especially useful if you’re applying for loan financing, for instance, buying a home, a car, or even leasing an apartment. If you work for a company, you can always secure a certificate of employment. Sometimes, if you work for a top corporation in your city, creditors will be quick in their approval. If you lack documents, though, you might have to go through hoops before you can convince them of your financial capability.

Most of the time, you can present your tax documents as proof of income. But for some of us who work freelance in the informal sector (meaning you don’t pay taxes), this could be a problem. In some places, you might be asked for business documents. In my city, for instance, banks and financing companies ask for business registration and a mayor’s permit. And that’s for a “self employed” classification!

Most freelance writers and bloggers bear the responsibility of taking care of their taxes and social security payments. No one else takes care of these for you automatically, unless you can afford to hire your own accountant. We don’t even have group health insurance, so those who buy insurance have to pay a non-discounted rate.

As for me, I usually use bank statements to back up my claims for income. Whether my revenue comes through PayPal or bank transfers, these all go through several bank accounts, which–I’m quite thankful–are all at least two to three years old. I also have some contracts with freelance clients. Sometimes it’s difficult to explain that clients can come from all over the world, and that contracts are transmitted by scanned or faxed documents. But so far I haven’t experienced any big hitches.

Have you experienced a situation wherein you need to prove financial capability, but you’re having difficulties giving documents because you work freelance? What documents have you used? Or what alternatives do you have?

My internet connection had been crawling the past few days. I’ve checked with my DSL provider, and my account seems fine. And for some reason, it’s not with all websites that I’m having difficulties. Then I just recently learned that an earthquake has caused

My internet connection had been crawling the past few days. I’ve checked with my DSL provider, and my account seems fine. And for some reason, it’s not with all websites that I’m having difficulties. Then I just recently learned that an earthquake has caused  Performancing is happy to announce a new Performancing Service,

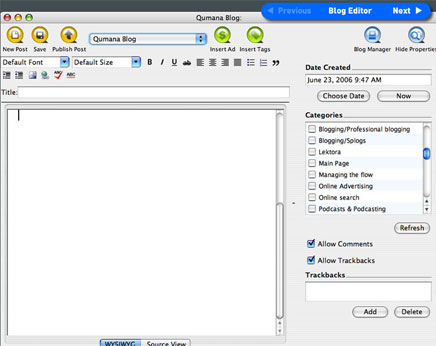

Performancing is happy to announce a new Performancing Service,

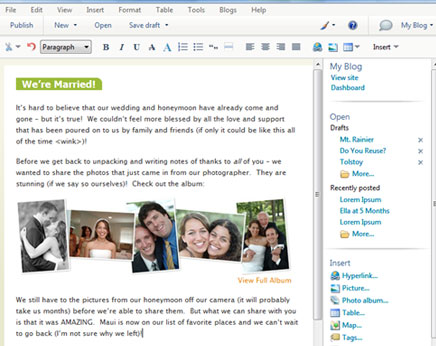

Getting the right web host for your blog is vital — get it wrong and your blog could be incapacitated, offlined or shut down, or you could end up paying far too much for the service.

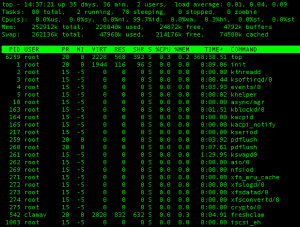

Getting the right web host for your blog is vital — get it wrong and your blog could be incapacitated, offlined or shut down, or you could end up paying far too much for the service. Operating System / Web Server

Operating System / Web Server Disc Space

Disc Space Bandwidth

Bandwidth Shell Access

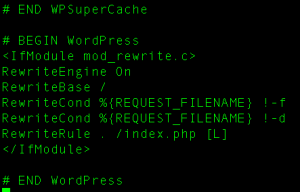

Shell Access htaccess

htaccess